International Finance Career Opportunities: What UK Professionals Need to Know About Working Abroad

The global finance sector continues to offer compelling opportunities for UK professionals seeking to advance their careers internationally. With Brexit reshaping the financial landscape and remote working becoming more prevalent, many UK finance professionals are exploring executive positions abroad, particularly in jurisdictions like Cyprus that offer favourable business environments and growing investment sectors.

For senior finance professionals, international roles such as the Chief Financial Officer in Cyprus position at companies like PUNIN GROUP represent significant career advancement opportunities. However, before pursuing such roles, UK professionals must carefully consider the complex financial implications of working overseas, from tax obligations to pension arrangements and currency exposure.

Understanding the international finance career landscape requires careful consideration of both opportunities and challenges. Cyprus, in particular, has emerged as an attractive destination for finance professionals due to its strategic location, EU membership, and business-friendly regulatory environment.

Cyprus as a Financial Hub for UK Professionals

Cyprus has established itself as a significant financial centre within the European Union, offering particular advantages for UK professionals post-Brexit. The island's legal system, based on English common law, provides familiarity for UK professionals, whilst its legal and regulatory framework maintains alignment with EU standards.

The jurisdiction offers several compelling features for international finance professionals. Cyprus provides access to EU markets whilst maintaining competitive corporate tax rates and comprehensive double taxation treaties. The country's strategic position between Europe, Asia, and Africa makes it an ideal base for multinational operations, particularly for professionals experienced in cross-border finance and investment management.

For Chief Financial Officers and senior finance professionals, Cyprus presents opportunities across various sectors including real estate development, hospitality, investment management, and international corporate services. The regulatory environment supports complex group structures whilst maintaining transparency and compliance with international standards.

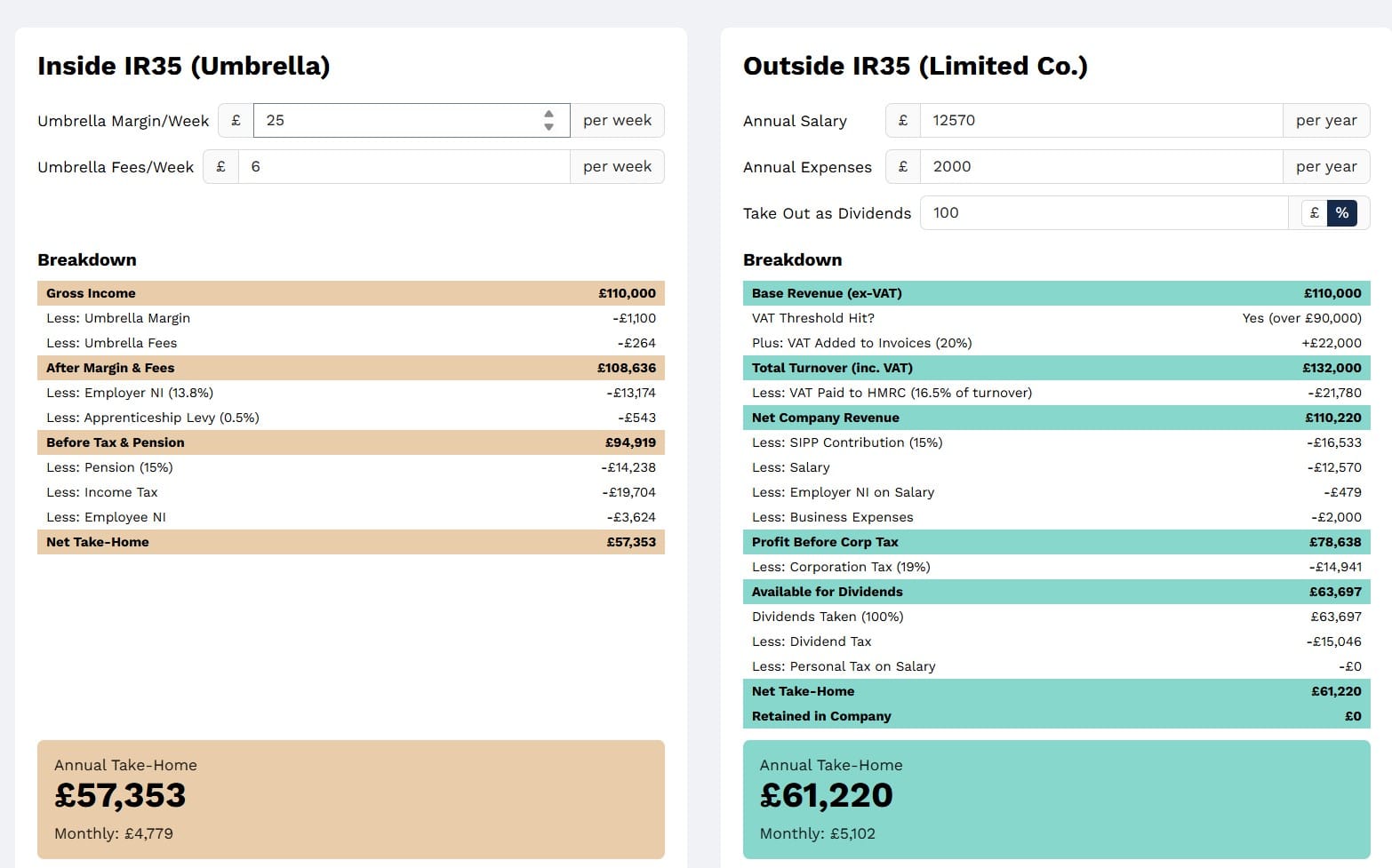

Tax Implications for UK Residents Working Abroad

UK professionals considering international finance roles must navigate complex tax implications that can significantly impact their overall financial position. The UK operates a residence-based tax system, meaning individuals who become non-UK resident for tax purposes may be able to reduce their UK tax liability, though this involves careful planning and professional advice.

Cyprus offers attractive tax arrangements for finance professionals, including corporate tax credits and incentives that can benefit both employers and employees. The jurisdiction's corporate income tax structure provides competitive rates whilst maintaining compliance with EU state aid rules.

However, UK professionals must consider several key factors when evaluating overseas opportunities. These include potential liability for UK tax on worldwide income if they remain UK resident, the impact on National Insurance contributions, and the availability of foreign tax credits. The statutory residence test determines UK tax residence status based on factors including days spent in the UK, family ties, and work patterns.

Additionally, professionals should consider the potential application of anti-avoidance legislation, particularly if the overseas role is temporary or if there are ongoing UK connections. The remittance basis of taxation may be available for UK residents who are not UK domiciled, though this involves additional compliance obligations and potentially higher tax costs.

Pension Considerations and Retirement Planning

International careers can significantly impact pension arrangements and long-term retirement planning. UK professionals working abroad must carefully consider the implications for both defined benefit and defined contribution pension schemes.

For those with UK workplace pensions, key considerations include whether contributions can continue whilst working overseas, the impact on annual allowances, and potential restrictions on accessing pension benefits. Some occupational pension schemes may limit or prohibit overseas transfers, whilst others may allow continued participation subject to specific conditions.

The Qualified Recognised Overseas Pension Scheme (QROPS) framework allows pension transfers to qualifying overseas schemes in certain circumstances. Cyprus hosts several QROPS providers, potentially allowing UK professionals to transfer existing UK pension benefits whilst maintaining tax-efficient growth. However, such transfers involve complex rules around member payments charges, reporting requirements, and potential UK tax charges on subsequent benefits.

State pension entitlement may also be affected by periods of overseas employment. UK professionals should consider voluntary National Insurance contributions to maintain their contribution record and protect future state pension entitlement. The rules around state pension uprating for UK nationals living in different countries vary significantly, with EU countries generally providing more favourable treatment than non-EU jurisdictions.

Currency Risk and International Compensation

Finance professionals accepting international roles face significant currency exposure that requires careful management. Compensation packages denominated in foreign currencies create ongoing exchange rate risk that can substantially impact real returns when converted to sterling.

Cyprus uses the Euro, meaning UK professionals face EUR/GBP exchange rate volatility throughout their employment period. Historical data shows this currency pair can experience significant fluctuations, with moves of 10-20% over 12-month periods not uncommon during volatile market conditions.

Professionals should consider various currency hedging strategies to manage this exposure. These might include negotiating partial sterling compensation, using forward currency contracts to lock in exchange rates for regular transfers, or maintaining diversified currency holdings. Some employers may offer currency adjustment mechanisms within compensation packages, though these are relatively uncommon.

The timing of currency conversions can significantly impact overall returns. Professionals should develop systematic approaches to currency management rather than making ad-hoc decisions based on short-term market movements. This might involve regular monthly transfers to smooth exchange rate volatility or strategic timing based on longer-term currency trends.

Regulatory Compliance and Professional Standards

Senior finance roles in international jurisdictions require deep understanding of complex regulatory frameworks. Cyprus-based finance professionals must navigate both local regulatory requirements and broader EU compliance obligations, including EU financial directives that govern multinational business operations.

International Financial Reporting Standards (IFRS) play a crucial role in multinational finance operations. Professionals must understand IFRS consolidation guidelines for group financial statements, particularly IFRS 10 consolidated financial statements requirements that govern how parent companies prepare group accounts.

For UK professionals, maintaining relevant qualifications and continuing professional development becomes more complex when working internationally. Professional bodies such as ACCA, ICAEW, and CIMA have different requirements for overseas members, including potential additional compliance obligations and restrictions on practising rights.

Anti-money laundering and know-your-customer requirements vary between jurisdictions and may be more stringent than UK equivalents. Finance professionals must ensure they understand local compliance obligations and maintain appropriate systems and controls to meet regulatory expectations.

Essential Qualifications and Skills Development

The international finance sector demands specific qualifications and competencies that extend beyond traditional UK finance roles. CFO positions typically require comprehensive understanding of cross-border tax planning, international treasury management, and multi-jurisdictional regulatory compliance.

Professional qualifications such as ACCA, CFA, or MBA credentials provide international recognition and credibility. However, local regulatory requirements may demand additional certifications or registrations, particularly for roles involving regulated activities or client-facing responsibilities.

Language skills increasingly differentiate candidates in international markets. Whilst English remains the primary business language in many international finance roles, additional languages can provide significant competitive advantages, particularly for roles involving diverse stakeholder management or regional expansion activities.

Technology competency has become essential for modern finance roles. International positions often require familiarity with multiple ERP systems, consolidation platforms, and regulatory reporting tools. Understanding of automation, artificial intelligence applications in finance, and data analytics capabilities are increasingly valuable differentiators.

Risk Management and Due Diligence

International career moves involve various risks that require careful evaluation and mitigation strategies. Political and economic stability in the target jurisdiction affects both short-term career prospects and long-term financial security.

Cyprus benefits from EU membership and eurozone participation, providing relative stability compared to many international destinations. However, professionals should consider factors such as banking system stability, regulatory changes, and potential impacts from broader European political developments.

Employment law differences can significantly impact job security, notice periods, and termination arrangements. UK professionals should carefully review employment contracts with qualified legal advice, paying particular attention to restrictive covenants, termination clauses, and dispute resolution mechanisms.

Healthcare and insurance arrangements require careful consideration, particularly for professionals with families. European Health Insurance Cards provide basic coverage within the EU, but comprehensive private health insurance is typically necessary for adequate protection.

The process of relocating internationally involves significant practical and financial considerations. These include property transactions, school arrangements for children, and establishing local banking and financial services relationships. Professional relocation services can provide valuable support, though these represent additional costs that should be factored into overall financial planning.

Long-term Career Strategy and Repatriation Planning

International finance careers require strategic long-term planning that considers both advancement opportunities and eventual repatriation scenarios. Professionals should maintain UK professional networks and qualifications whilst developing international expertise and contacts.

The experience gained in international finance roles, particularly in jurisdictions like Cyprus that serve as regional hubs, can provide significant career advantages. Understanding multinational group structures, international tax planning, and cross-border regulatory compliance creates expertise that is highly valued in the global finance market.

However, professionals should also consider repatriation scenarios and maintain flexibility for potential returns to the UK market. This might involve maintaining UK professional memberships, staying current with UK regulatory developments, and preserving relationships with UK-based recruiters and employers.

Career progression in international markets may differ from UK patterns, with greater emphasis on regional expertise and cross-cultural competency. Professionals should actively seek roles that provide broad international exposure and develop skills that are transferable across multiple jurisdictions.

The international finance sector offers compelling opportunities for UK professionals seeking career advancement, though success requires careful planning and risk management. From navigating complex tax implications to managing currency exposure and maintaining regulatory compliance, international finance careers demand comprehensive preparation and ongoing professional development.

For those considering such opportunities, thorough research and professional advice are essential to maximise benefits whilst mitigating potential risks. The rewards can be substantial, both in terms of career advancement and financial returns, but only for those who approach international opportunities with appropriate preparation and realistic expectations.