IR35 Calculator: Compare Your Inside vs Outside Earnings and Make Informed Decisions

The IR35 legislation has fundamentally changed how contractors work in the UK, creating two distinct pathways that dramatically impact take-home pay and financial planning. Whether you find yourself caught inside or operating outside these off-payroll working rules can mean the difference of thousands of pounds annually, making it crucial to understand not just the compliance aspects, but the real-world financial implications of each scenario.

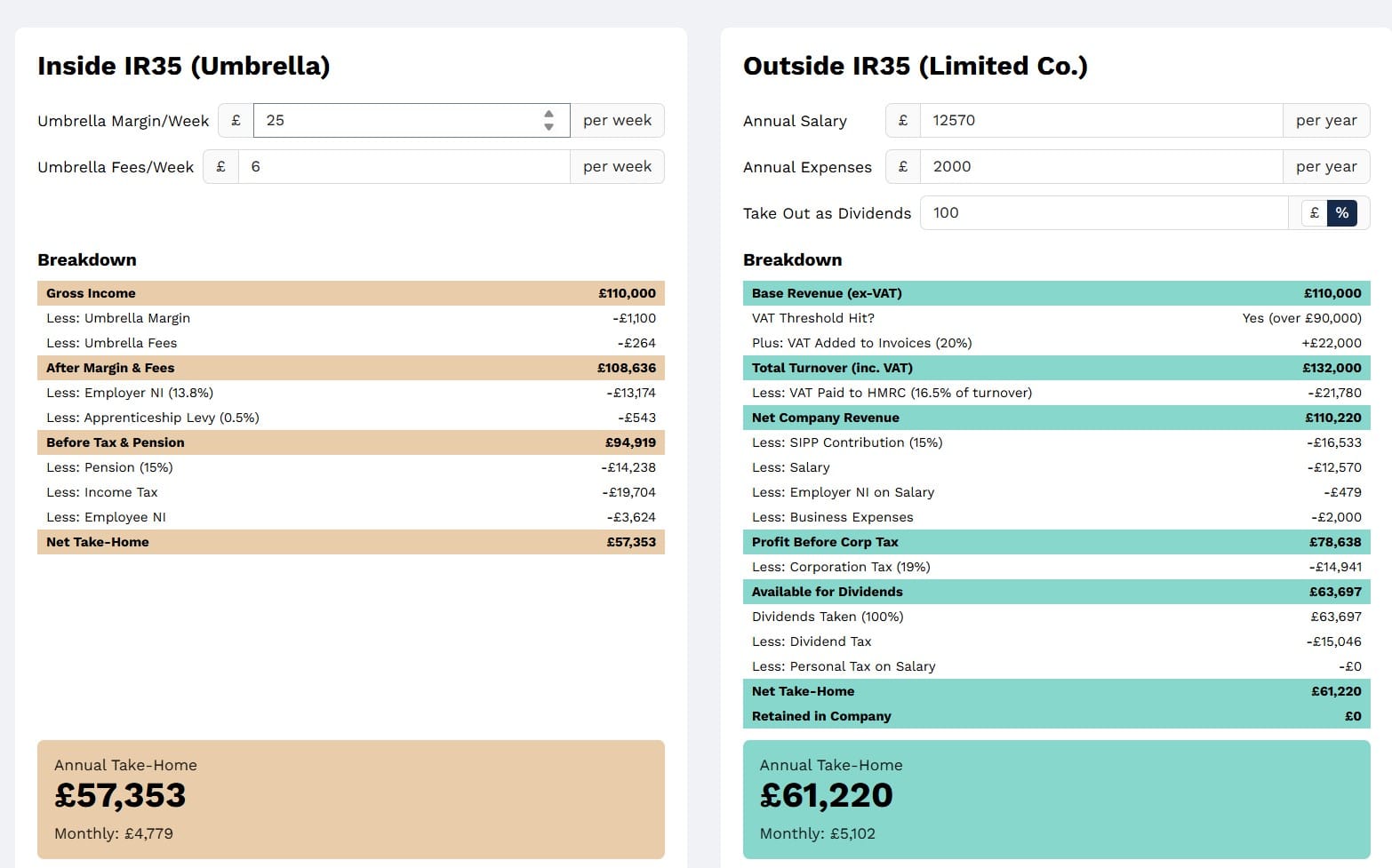

Navigating this complex landscape requires more than theoretical knowledge. That's why we've developed our inside ir35 vs outside ir35 calculator, a comprehensive tool that allows contractors to input their specific circumstances and see exactly how different rates and setups compare across both pathways. This practical approach helps cut through the confusion and provides concrete numbers to inform your contracting decisions.

The journey toward understanding IR35 begins with recognizing that these rules weren't created in isolation. The UK's approach to off-payroll working reflects broader concerns about tax avoidance and employment rights that have evolved over decades. Personal service limited companies became increasingly popular as contractors sought to optimize their tax position, leading to legislative responses that now define the contracting landscape.

Understanding the Inside IR35 Reality

When a contract falls inside IR35, the financial reality changes dramatically. Contractors effectively become deemed employees for tax purposes, which means saying goodbye to many of the tax advantages that made contracting attractive in the first place. The most immediate impact hits through PAYE taxation, where income tax and National Insurance contributions are deducted at source, just like traditional employment.

Working through an umbrella company becomes the typical solution for inside IR35 contracts. However, this arrangement introduces additional complexities that many contractors don't initially appreciate. The umbrella company takes a margin, typically ranging from £15 to £30 per week, which represents a direct reduction in take-home pay. More significantly, contractors lose control over the timing of their tax liabilities and cannot benefit from dividend taxation strategies.

The apprenticeship levy adds another layer of cost for inside IR35 contractors. At 0.5% of the annual pay bill for companies with payrolls exceeding £3 million, this levy is typically passed through to contractors via their umbrella companies. While individual contractors might not notice this cost directly, it reduces the overall value proposition of their services and can impact rate negotiations with end clients.

National Insurance contributions deserve particular attention in the inside IR35 scenario. Contractors face both employee and employer National Insurance, with the umbrella company typically passing the employer portion back to the contractor. This double hit can add up to 25.8% in National Insurance alone for higher-rate taxpayers, significantly eroding the day rate advantage that contractors traditionally enjoyed.

The Outside IR35 Advantage

Operating outside IR35 through a limited company opens up significantly more tax-efficient strategies. The ability to split income between salary and dividends forms the cornerstone of this approach, allowing contractors to optimize their position across multiple tax regimes simultaneously. This flexibility extends beyond simple tax planning to encompass broader business and financial planning opportunities.

Dividend taxation remains more favourable than employment income, despite recent rate increases. For 2023/24, dividend tax rates stand at 8.75% for basic rate taxpayers, 33.75% for higher rate, and 39.35% for additional rate taxpayers. These rates, while higher than previous years, still compare favorably to the combined income tax and National Insurance burden faced by inside IR35 contractors.

The optimal salary strategy for outside IR35 contractors typically involves setting director salaries at the National Insurance threshold, currently £12,570 annually. This approach minimizes National Insurance contributions while maximizing the remaining funds available for dividend extraction. However, professional tax guidance becomes essential when implementing these strategies, as incorrect implementation can trigger compliance issues.

Business expenses represent another significant advantage of outside IR35 operation. Legitimate business costs, including professional development, equipment, travel, and office expenses, can be offset against corporation tax. This includes expenses that wouldn't qualify for relief under PAYE arrangements, such as home office costs and professional subscriptions.

Advanced Tax Strategies and Considerations

The corporation tax landscape adds another dimension to outside IR35 planning. With the current corporation tax rate at 19% for profits up to £50,000 and 25% for profits above £250,000, contractors need to consider timing strategies for extracting profits. Some choose to retain profits within the company during high-earning years, extracting them later when personal tax rates might be more favourable.

VAT registration introduces both opportunities and administrative burdens. While contractors can reclaim VAT on business expenses, they must also charge VAT on their services, potentially making them more expensive to end clients. The VAT flat rate scheme offers a simplified approach but requires careful consideration of the limited cost trader rules that came into effect in recent years.

Understanding tax-efficient structures becomes particularly important for contractors considering long-term wealth building. Pension contributions through the company can be highly tax-efficient, with annual allowances potentially reaching £60,000 for high earners under certain circumstances. These contributions reduce corporation tax while building retirement wealth outside the personal tax system.

Business Asset Disposal Relief (BADR), formerly Entrepreneurs' Relief, offers potential capital gains tax advantages when contractors eventually wind up their companies. With qualifying gains taxed at just 10% up to a lifetime limit of £1 million, this relief can provide significant tax savings for successful long-term contractors.

The Compliance and Administrative Reality

Compliance requirements differ dramatically between inside and outside IR35 arrangements. Inside IR35 contractors working through umbrella companies face minimal administrative burden, with the umbrella handling tax returns, VAT registration, and most compliance matters. This simplicity comes at a cost, both in terms of umbrella margins and reduced tax efficiency.

Outside IR35 contractors must embrace significantly more administrative responsibility. Annual accounts, corporation tax returns, and personal tax returns become regular requirements. VAT returns add quarterly obligations for registered businesses. While these tasks can be outsourced to accountants, they represent both cost and time commitments that inside IR35 contractors avoid.

Recent regulatory changes have shifted determination responsibilities to end clients in many sectors, reducing contractors' direct compliance burden but potentially limiting available opportunities. Medium and large companies now make IR35 determinations, often erring on the side of caution by classifying more contracts as inside IR35.

The risk profile differs significantly between the two approaches. Inside IR35 contractors face minimal tax risk, with most obligations handled by umbrella companies. Outside IR35 contractors bear greater responsibility for correct classification and tax compliance, though legitimate business arrangements typically face limited challenge from HMRC when properly structured and documented.

Practical Calculation Considerations

Real-world IR35 calculations involve multiple variables that theoretical discussions often oversimplify. Day rates, contract duration, annual earnings, and personal circumstances all influence the optimal approach. Professional compliance resources can help contractors understand these variables, but practical calculation tools provide the clearest picture of financial implications.

Holiday pay, sick pay, and other employment benefits factor into inside IR35 calculations through umbrella companies. These statutory entitlements are funded from the contractor's gross receipts, effectively representing prepaid amounts rather than additional benefits. Understanding this mechanism helps contractors make accurate comparisons between inside and outside IR35 scenarios.

Expenses and allowances create another calculation complexity. Inside IR35 contractors can claim limited travel and subsistence expenses, while outside IR35 contractors can offset a broader range of business expenses against corporation tax. The cumulative impact of these differences often exceeds contractors' initial expectations.

Strategic Decision Making

The choice between inside and outside IR35 extends beyond immediate tax efficiency to encompass career strategy and personal circumstances. Contractors with irregular income patterns might benefit from the smoothed earnings profile that company structures provide. Those preferring administrative simplicity might accept the tax cost of inside IR35 arrangements for reduced compliance burden.

Market conditions increasingly influence IR35 positioning. Current employment regulations mean that some clients only engage contractors through inside IR35 arrangements, limiting choice regardless of the actual working relationship. Contractors must balance tax efficiency with market access when making strategic decisions.

Geographic factors also play a role, with different regions showing varying client attitudes toward IR35. London's financial services sector, for example, has largely moved toward inside IR35 arrangements following regulatory pressure, while other sectors and regions maintain more flexibility.

The financial modelling process benefits significantly from using specialized tools that account for all relevant variables. Our calculator incorporates the complex interactions between different tax regimes, allowances, and business structures to provide comprehensive comparisons that reflect real-world scenarios rather than simplified examples.