Introducing the ISA Bridging Calculator: Your Path to Early Retirement

Planning to retire early but worried about the gap between leaving work and accessing your pension? We're excited to announce the launch of our ISA Bridging Calculator, a powerful new tool designed to help UK savers and investors understand if they can bridge the gap to pension access age using their Stocks & Shares ISA.

What is ISA Bridging?

ISA bridging is a popular financial strategy for anyone hoping to retire or stop working before they can access their pension (currently age 55, rising to 57 in 2028). The approach is simple yet powerful: use your Stocks & Shares ISA to provide tax-free income during those crucial years between early retirement and pension access age.

Unlike pension withdrawals, which are subject to income tax (except for the 25% tax-free lump sum), ISA withdrawals are completely tax-free. This makes them an ideal vehicle for bridging the retirement gap, allowing you to maintain your lifestyle without triggering hefty tax bills.

Why We Built This Calculator

While ISA bridging is a well-established strategy in the FIRE (Financial Independence, Retire Early) community, we found that most people struggle to understand whether their current ISA savings and contribution plans are sufficient to achieve their early retirement goals.

Existing calculators either oversimplify the math or fail to account for critical factors like investment growth, platform fees, and the need to maintain contributions during accumulation years. Our ISA Bridging Calculator addresses these gaps with detailed projections and two flexible calculation modes.

Key Features

The calculator offers two distinct approaches to match your planning style:

1. Target Annual Income Mode

Enter the post-tax income you want to achieve in early retirement, and the calculator determines when you can realistically reach that goal. This mode is perfect if you have a specific lifestyle cost in mind and want to know: "When can I afford to retire?"

2. Target Early Retirement Age Mode

Already have a retirement age in mind? This mode calculates how much annual income your ISA can sustainably provide if you retire at your chosen age. It's ideal for those with a firm timeline who want to understand their income possibilities.

Comprehensive Inputs

The calculator accounts for all the key variables:

- Current age and pension access age: Define your planning horizon (with a minimum pension access age of 55)

- Current ISA balance: Your starting point

- Annual ISA contributions: How much you plan to add each year (capped at the £20,000 annual allowance)

- Target income or retirement age: Depending on your chosen calculation mode

- Fund fees: Annual management fees and fee caps to accurately model real-world costs

Detailed Projections

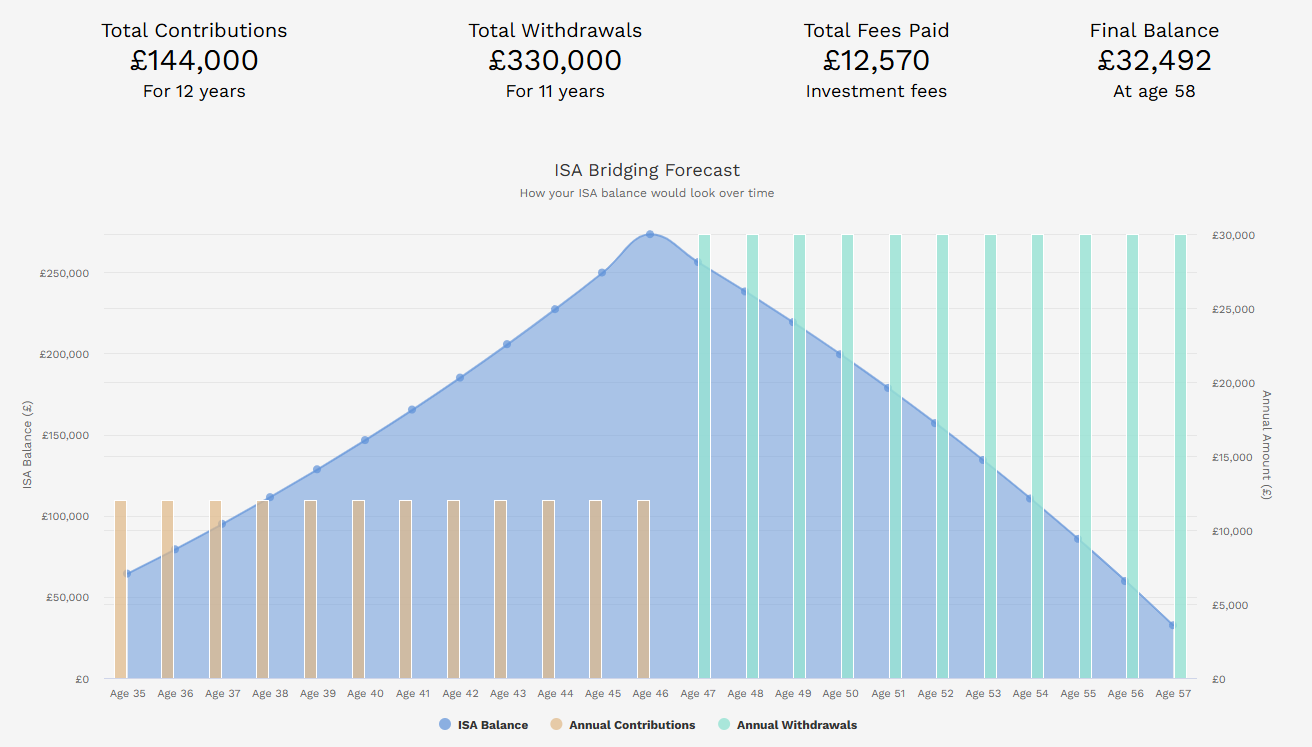

Once you've entered your details, the calculator provides:

- Goal achievement status: Clear indication of whether your plan is viable

- Total contributions and withdrawals: See the full picture over your timeline

- Year-by-year breakdown: Detailed table showing contributions, withdrawals, balance, pot growth, and cumulative fees for each year

- Interactive charts: Visual representation of your ISA balance trajectory, contributions, and withdrawals over time

- Total fees paid: Understanding the true cost of investment fees over time

Using the calculator, you'll discover:

- Whether this goal is achievable with your current plan

- If not, what adjustments you need to make (higher contributions, later retirement, or lower income needs)

- The exact trajectory of your ISA balance over the 23-year planning horizon

- How much you'll pay in investment fees along the way

How It Works: The Methodology

Our calculator uses sophisticated financial modelling to project your ISA journey:

- Assumptions: We assume 5% annual growth (net of 2.5% inflation) on your investments. This is a reasonable long-term expectation for a diversified equity portfolio, though actual returns will vary.

- Contribution Phase: During the years before you can withdraw, your ISA balance grows through contributions (up to £20,000 per year), investment growth, minus fund fees.

- Withdrawal Phase: Once you reach your target retirement age (or can afford your target income), the calculator determines level annual withdrawals that will sustain you until pension access age, using time-value-of-money principles to ensure your pot lasts the entire bridging period.

- Smart Withdrawal Calculations: For age-based calculations, we use actuarial mathematics to determine sustainable withdrawal amounts that account for ongoing investment growth and fees. This ensures you won't run out of money before reaching pension access age.

- Goal Validation: For income-based calculations, we simulate whether your ISA can sustain the target income throughout the bridging period while accounting for ongoing growth and fees, telling you exactly when (if ever) you'll be able to achieve your target income.

Important Considerations

While the ISA Bridging Calculator is a powerful planning tool, remember:

- Tax efficiency: The calculator focuses solely on ISA withdrawals. In reality, you might have other income sources that could affect your overall tax position.

- Investment risk: The 5% real growth assumption is a long-term average. Actual returns will fluctuate, and you could experience negative returns in some years. Consider building a cash buffer for sequence-of-returns risk.

- ISA contribution limits: The £20,000 annual ISA allowance is subject to government policy and may change in future years.

- Pension age changes: The minimum pension access age is currently 55 but is scheduled to rise to 57 in 2028. Future changes could affect your timeline.

- Inflation: While we account for 2.5% inflation in our growth assumptions, actual inflation may differ, affecting your income needs.

Beyond the Calculator: Saving Tool Advanced

The ISA Bridging Calculator serves as an excellent starting point for understanding if early retirement via ISA withdrawals is feasible. However, real-world financial planning is more complex.

If you need more sophisticated modelling that accounts for:

- Multiple income sources during early retirement

- Defined Benefit (final salary) pensions alongside Defined Contribution pensions

- Tax considerations including Personal Allowance, tax bands, and National Insurance

- Other investments and savings vehicles

- Varied contribution rates over time

- Monte Carlo simulations for investment risk

Then consider using Saving Tool Advanced, our comprehensive financial forecasting platform. It simulates your entire financial journey year-by-year, providing insights into every aspect of your wealth accumulation and drawdown strategy.

Try The ISA Bridging Calculator Now

Ready to explore if ISA bridging could work for you? Visit our ISA Bridging Calculator and start planning your path to financial independence.

Whether you're years away from early retirement or actively building your ISA pot, understanding the mathematics of ISA bridging is crucial for making informed decisions about your financial future. The calculator removes the guesswork and provides clear, data-driven insights into what's possible with your current resources and plans.

Remember: the earlier you start planning (and contributing), the more options you'll have for achieving your early retirement dreams. Your future self will thank you for taking action today.

Disclaimer: This calculator is for educational and planning purposes only. It does not constitute financial advice. Investments can go down as well as up, and past performance is not a guarantee of future returns. Consider seeking advice from a qualified financial adviser for personalised guidance on your retirement planning.